M1 Finance is a financial services company that offers retirement accounts, investment management services, portfolio analysis tools – even high-interest checking accounts and savings accounts. But does this mean that you are a safe place to invest your money? In this article I will tell you more about the services offered by M1 Finance and whether M1 Finance it is safe and legitimate.

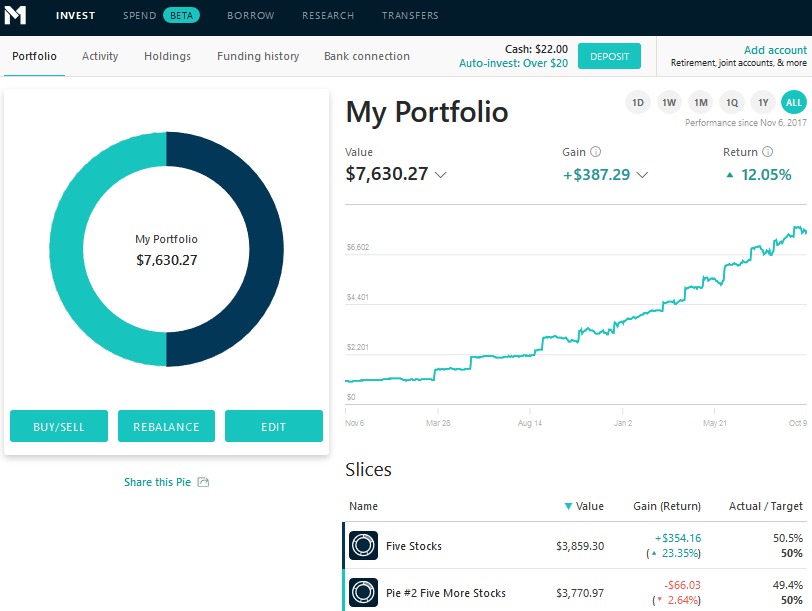

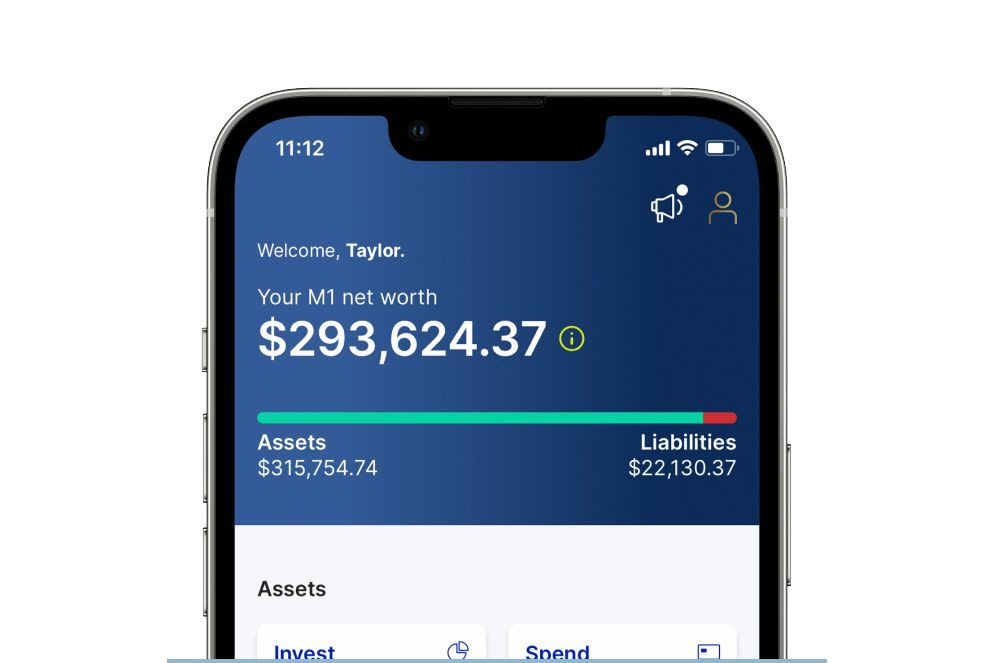

M1 Finance is an investment app that offers a wide range of financial products and services, including a robo–advisor investment platform where you can buy ETF and stock portfolios, retirement accounts and portfolio analysis tools-you can even open a checking account or a high-yield savings account with M1 Finance.

M1 Finance may be a popular investment platform, but does that make it a safe place to invest your money?

In this article, I will explain how M1 Finance protects its clients and let them know if they are safe and legitimate.

About M1 Finance

M1 Finance was founded and is headquartered in Chicago, Illinois. The company currently manages nearly 7 billion in assets and serves more than 750,000 members.

Although the company’s growth has been impressive, industry giant Fidelity currently manages more than 4.5 trillion in client assets.

Is M1 Finance Safe?

The answer is yes. M1 Finance is a legitimate financial services company regulated by FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation).

The company’s website states that it uses “state-of-the-art security protection” and is provided by the FDIC. You can be sure that your deposits at M1 Finance are safe.

Although M1 Finance is a safe and legitimate company, the market investments you hold through M1 Finance are not guaranteed. No investment in the market is peril-free, so it is important that you do the right research before investing.

What is SIPC?

As mentioned earlier, M1 Finance is a member of the Securities Investor Protection Corporation (SIPC). This non-profit member company protects the clients of its members in the event of the insolvency of a member brokerage firm.

It provides funds to cover not found securities and cash from clients up to certain limits.

Since its inception more than 50 years ago, SIPC has recovered more than 141 billion in assets from more than 770,000 investors. SIPC does not cover losses due to market fluctuations.

If you have opened an account with M1 Finance and the company has gone bankrupt, SIPC will help you get your money back. However, SIPC would not cover losses due to a decrease in the market value of your investment or poor stock selection.

FDIC coverage

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the US government that provides deposit insurance to banks and credit unions. The FDIC coverage protects depositors in the event of a bank failure up to 250,000 per per account.

FDIC coverage can be confusing. Below is a table with the types of investments for which the FDIC is responsible and for which it is not responsible. Keep in mind that market investments such as stocks, mutual funds and ETFS are not covered by the FDIC.