The increase in construction costs means that real estate developers are more often dependent on complex — and potentially expensive – financing structures. Smarter modeling will help reduce borrowing costs.

The combination of inflation and rising rates makes it not only more expensive to buy houses, but also to build. According to a current assessment by the US Federal Reserve, the producer price index for construction materials increased from 235 in June to 350 in June, an increase of 49% in just two years. Consumer price inflation is also rising, with rates of 5% to 9% in most developed countries, prompting central banks to raise interest rates.

Rising costs mean property developers have to borrow more, and they often rely on complex financing structures that can impact profits. As I will illustrate, choosing the wrong financing option can add in the middle 1% and 5% to the final price — which is hundreds of thousands of buck on a larger project. With more than 412 billion in commercial construction loans in July in the United States alone, this could cost the real estate industry billions of buck every year.

I have been working in real estate financing for more than 15 years and have obtained financing for more than 100 commercial real estate projects, including houses, hotels and commercial properties. I have observed that many developers tend to focus their attention on day-to-day needs and have less experience in evaluating key financing decisions and understanding all the nuances. You may not be using a financing model for real estate development at all, or you may be trying to do it yourself instead of employing a financial modeling expert.

These models often oversimplify or use inaccurate assumptions that distort the results. This problem can be exacerbated if a developer uses complex financing structures that include subordinated debt and third-party equity. Even for financial professionals who know the mechanisms of structured finance, this type of financing can be difficult.

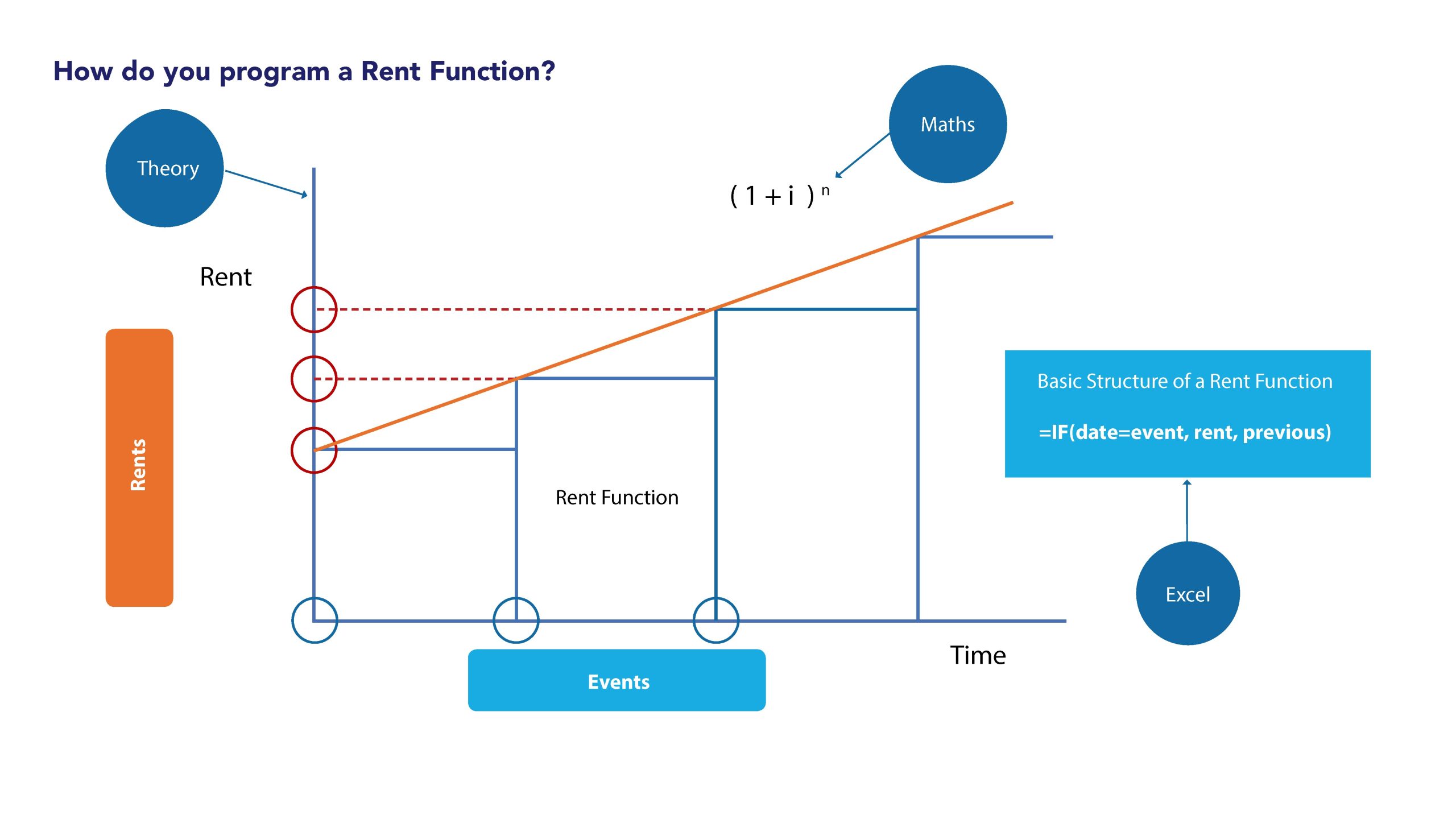

Real estate financing is a unique business, and it is difficult to model without understanding the underlying assumptions. Below I will describe three common mistakes that I have observed over the years and explain how intelligent modeling can help you avoid them.

How real estate projects are financed

A real estate development project is usually financed by a combination of senior loans and third-party bonds. It is also common to solicit more funds from subordinated debt investors and/or third parties when project costs increase.

Priority lenders take a “last-in, first-out” approach when financing projects. This means that they expect all subordinated financing to be invested before releasing funds. The main lender then finances the cost of completing the project, at which point it is repaid first.

As with most financing structures, senior debt securities have the strongest security and rank first in the capital pile, which entails the least costs: a relatively low interest rate and few fees. Subordinated debt is accompanied by a higher interest rate and equity shares in the profits of the project and sometimes also have a priority return.

To illustrate the effect of different combinations of these financing options, we use a simple hypothetical construction project called “Project 50.”the Project 50 community consists of 50 single-family homes Worth 1 thousand each once construction is complete.

Real estate projects require an initial lump sum financing to acquire the property. In our example, this is 15 thousand. After that, the developer takes monthly withdrawals to cover the construction costs as the project progresses.

As a rule, withdrawals can vary from month to month due to changes in expenses and Inflation of construction costs. However, for the purposes of this article, we assume that the 50 16 project will require equal uses of the construction cost of 20 thousand—which means that it will take 1.25 thousand at the end of each month up to and including month 16.

Construction costs are predicted in advance by the developer and the lender, with the lender using an external surveyor to monitor costs and sign monthly usage requests throughout the project.