The best Roth IRA investments are focused on security, online access and, of course, the highest return –all these elements must be taken into account when choosing your options.

One of the best investment tools to prepare for retirement is a Roth IRA. This gives you the opportunity to earn a tax-free income after retirement.

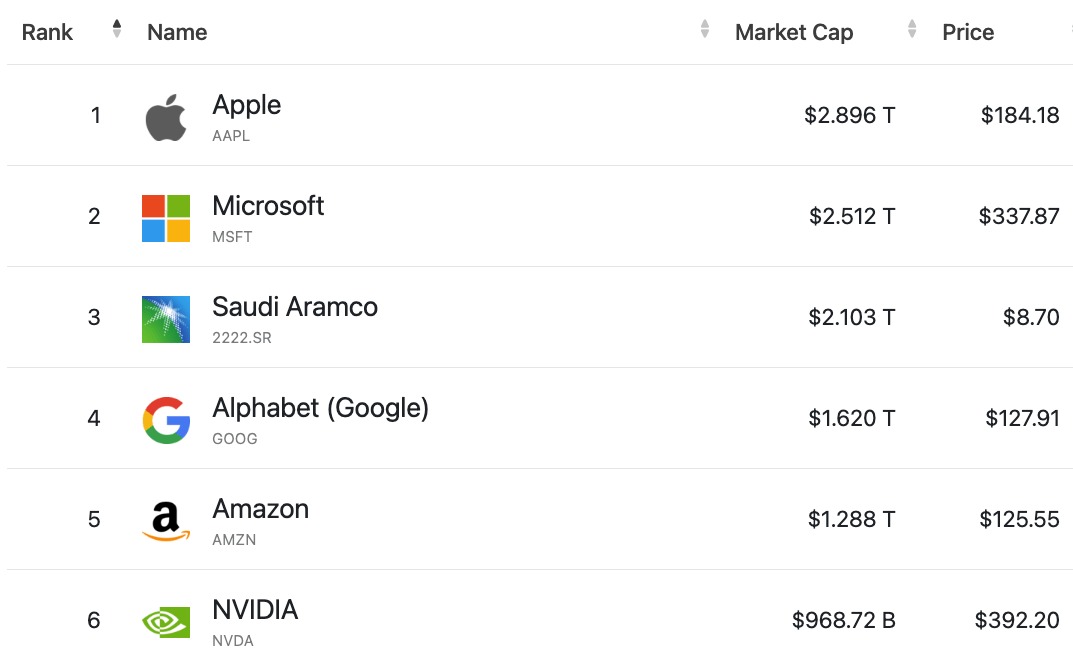

Our picks for 6 best investments for Roth IRA

Usually, when we provide “Best for” financial services guides, we also offer a ranking that we believe is the best of the group. However, in this matter, we cover wide asset classes. Each is either necessary for building a successful Roth IRA, or at least highly desirable.

For this reason, we will not give a ranking for our selection of the best investments for a Roth IRA. But we will provide you with what each asset class in your portfolio is best suited for.

EquiBest Investments for Roth IRA in 2024ties: Long-term Growth

Bonds / Fixed Income Securities: Capital Security/peril Reduction

ETF: Passive diversification of stocks and bonds

Mutual funds: active diversification of stocks and bonds

Cryptocurrency: alternative investment/ long-term growth

Real estate crowdfunding: investing in real estate transactions or funds

1. Stocks: ideal for long-term growth

Minimum Investment: None

peril level: moderate to high

Fees: 0

For long-term growth, stocks are the most fundamental capital that can be held in a Roth IRA. That’s because a Roth IRA is a retirement plan that is usually held for decades. Bank assets that earn less than 1% will not produce a large retirement nest egg.

But stocks, which average about 10% a year, can turn regular contributions into a seven-figure portfolio.

You need to learn how to start investing in stocks, which requires knowledge about stocks, trading, platforms and other terms. It is also important to choose a brokerage account if you want to invest in individual stocks.

A brokerage account is an investment account for your individual freely tradable securities, such as stocks. The best online stock brokers not only allow you to trade stocks online, but also offer commission-free transactions. Examples include E*TRADE and TD Ameritrade.

If you are an advanced investor, you can also check out the best investment apps. They offer optimized trading at high speed, but with little support or knowledge.

On the other end of the spectrum, you may want to check out the best robo-advisors if you want to invest in stocks but don’t feel comfortable choosing or managing your own investments.

2. bonds and fixed income securities: ideal for capital security and peril mitigation

Minimum investment: 100 to 1,000

peril level: zero to moderate

Fees: Nominal, based on the broker

The word “obligations” covers a vast territory. There is not a single bond, but a mixture of different interest-bearing securities.

Unlike a share, which represents the ownership share of a business entity, a bond is a debt obligation and therefore has limited growth potential. It is issued for a fixed total with a fixed interest rate and is fully repaid at the end of the term.

At least in theory, bonds retain a constant value. For this reason, they offer capital security and peril reduction for an overall portfolio.

For example, a portfolio composed of 80% stocks and 20% bonds will have a lower volatility than a portfolio composed only of stocks.

The safest type of bonds is the best short-term investment for your money. These include money market accounts, certificates of deposit and short-term bonds and bond funds.

You should never dominate your portfolio, but a relatively small allocation will help minimize losses during a falling stock market.

If you are looking for higher interest rate bonds or bond equivalents, consider longer-term investments. In general, the longer the term of the bond, the higher the interest rate it will pay.

You can also consider investing part of your Roth IRA in an alternative investment platform such as YieldStreet.

YieldStreet allows you to invest in asset-based investments that generate higher returns, such as small business and real estate loans. These investments are guaranteed by body assets and pose less peril than stocks or bonds.

Overall, however, you can expect higher returns than you get from most income investments.