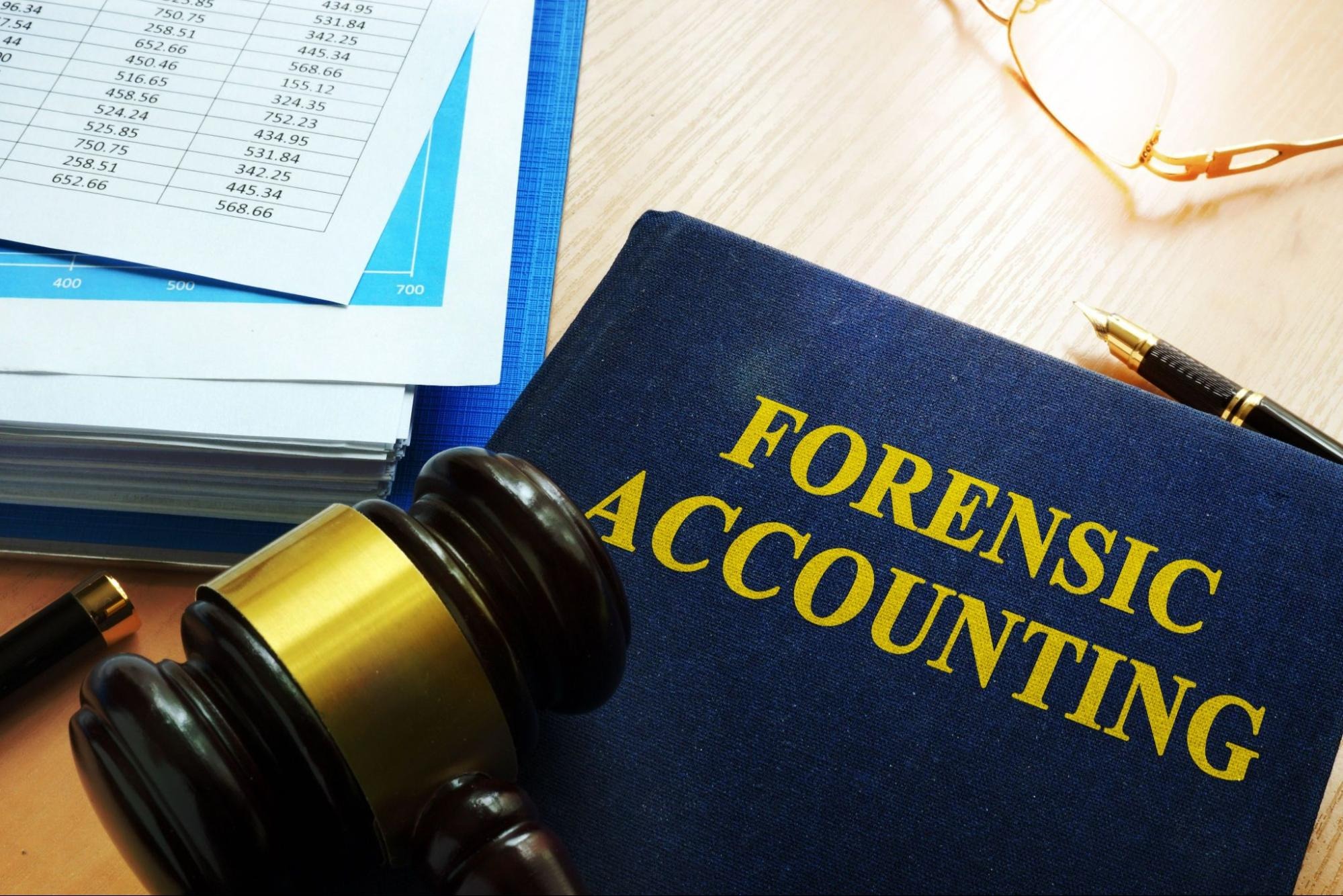

A few years ago, Neel Augustly—forensic accounting expert at Total, who worked as regional and divisional CFO at Medtronic and Johnson & Johnson—investigated the performance of a company at the request of its owner, a conglomerate. As is typical for forensic accountants, in his work he mixes both quantitative methods and qualitative tools, such as conversations, behavioral observations and on-site visits.

Augusty began this special investigation, as he often does, by examining audits of similar companies. He found that the company was much less profitable than others like it and that its profitability was out of line with expenses—both red flags. His next step was to spend a lot of time talking and listening to the company’s employees and suppliers.

Asking questions is crucial to getting people to open up to you, he says. “You have to be almost childish and ask out of pure ignorance ‘ Can you explain to me how this works? You tell me that, and my other source here tells me, how does it all fit together?’”

When Augusty spoke with the company’s suppliers, many complained about the low margins, which made no sense given the total the company claimed to be paying them. So he took the managing director of the company to dinner, under the pretext of catching up and discussing possible improvements.

“When people talk and feel comfortable, they tell them a lot of things that they probably shouldn’t,” Augusty says. “I asked [the managing director] why sellers complain about such low margins when we pay them so dearly. He said, “Oh, these guys don’t stop complaining for no reason.’The managing director made further comments that also touched Augusty: “He had just bought this piece of land here and this one there.”And I thought: this does not add up. Suddenly he has a lot of money to make these purchases.”

“That’s when I realized that he had skimmed the business by taking money owed to the sellers,” Augusty says. As a result of the investigation, the conglomerate dismissed the person in power and improved control and balance to ensure that this does not happen again.

What Is Forensic Accounting?

Forensic accountants, also known as investigative accountants, are usually associated with the investigation of delinquent activity, but that’s not all they do yet. These specialized practitioners have specific accounting ability and tools to study what is hidden under financial statements and to reveal other hidden problems and perils, including those linked to:

- deception: loss of capital due to unlawful or delinquent deception.

- Compliance with lawful requirements: taxes or fines due to non-compliance with laws.

- Liquidity: loss of capital due to excessive debt and insufficient equity.

- Investment: loss of capital due to an investment in a company in difficulty.

- Credit: loss of capital due to the loan of money to a borrower who is unable to repay.

In the more than 20 years in which the scandals and collapses of Enron and WorldCom catalyzed the introduction of the Sarbanes-Oxley act, the corporate peril environment has become more volatile and complex. The speed of technological innovations, supply chain disruptions and the upcoming climate crisis not only make it difficult to anticipate financial perils, but the increased volatility also provides fertile ground for deception.

Although traditional methods of analyzing financial perils can be effective in identifying and mitigating many problems, they are not always enough to reveal all kinds of financial perils. Given the business environment, there is a harmful underutilization of forensic peril analysis and forensic peril management, especially among small and medium-sized enterprises, says Erik Stettler, chief economist of Total. In his previous work for NERA Economic Consulting, he investigated the failures and quasi-failures of a number of leading American institutions during the Great Recession.

Many companies are trying to save money by conducting less stringent checks with internal employees, Stettler says, but this is peril, because employees may not have the necessary experience or be so used to how business is conducted in the company that they do not recognize red flags. The failure to detect deception, break regulations or reduce cash costs a company far more than the initial capital expenditures for specialized investigative accounting, which are usually in the middle 30,000 and 50,000 per project, he says. In contrast, a December study by multinational organizations found that the average annual cost of non-compliance was nearly 15 thousand.

Forensic accounting for the analysis of financial perils

Investigative accountants do more than just take a look at the financial statements. These specialists approach surveys holistically, integrating statistical analysis, market research, photographs or visual inspections of facilities, conversations with human sources and unexpired of the history, behavior and psychology of individuals and companies in order to find out the truth. For example, in order to check the income or expenses of a company, instead of checking only annual or quarterly financial data, forensic accountants can request real-time figures for the relevant period in order to more accurately observe fluctuations.

“When reviewing a loan, an investment or an m & A agreement or when conducting an audit, it is important to take a closer look beyond traditional financial data and also to consult other sources of information about a company in detail,” says Stettler. However, peril managers can’t just send a forensic accountant on a fishing expedition to see what they find. Forensic accounting is a significant investment and requires specific claims or concerns that need to be investigated.

A peril management framework can provide companies with a structured approach to identify, assess and mitigate different types of perils, including hiring a forensic accountant to investigate things further. If the framework reports financial irregularities, such as unusually high repayment activities on the part of borrowers, this may trigger a forensic investigation. This is due to the fact that higher repayment figures indicate a significant increase in income for the borrower. A forensic accountant would investigate whether this sudden stroke of luck could be linked to deception. Let’s take a closer look at how investigative accounting techniques can be applied in three main areas of peril.